In general terms, the process of estate administration involves identifying and claiming the probate assets belonging to the deceased person (decedent), paying all debts and estate/income taxes (if applicable), and ultimately transferring the net assets to the designated beneficiaries or next of kin.

In general terms, the process of estate administration involves identifying and claiming the probate assets belonging to the deceased person (decedent), paying all debts and estate/income taxes (if applicable), and ultimately transferring the net assets to the designated beneficiaries or next of kin.

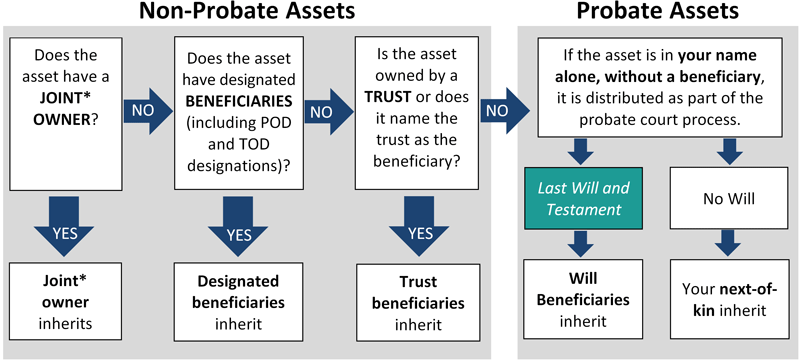

Which assets are probate assets?

Non-probate assets:

Non-probate assets include assets held as joint tenants with rights of survivorship, assets with a beneficiary designation, and assets held in the name of a trust or with a trust named as the beneficiary. Any asset held as joint tenants with rights of survivorship (JTWROS) will pass directly to the surviving joint owner. Assets with beneficiary designations may include life insurance policies, 401(k)s, IRAs, annuities, and assets with a pay-on-death (POD) or transfer-on-death (TOD) designation. These assets will pass directly to the beneficiary or beneficiaries who were designated on the asset (for instance, on a 401(k) application or beneficiary form, on a life insurance form, or on the decedent’s car title.) Non-probate assets can be claimed by the beneficiaries without involvement of probate court. The decedent’s Will does not control these assets.

Probate assets:

Probate assets are those assets held in the decedent’s individual name only, with no beneficiary designation (or no living beneficiary), and not held as joint tenants with rights of survivorship. These assets are required to pass through probate court and are distributed according to the decedent’s Will, and if there is no Will, to the decedent’s next of kin, according to state law. Examples may include real estate, stock, or a bank account titled in the decedent’s name alone.

*If held jointly with rights of survivorship

How does the probate process work?

Probate courts are responsible for ensuring that executors carry out their duties during the estate administration process.

An executor’s duties include notifying the decedent’s beneficiaries and next of kin, gathering assets, filing an inventory with the court, paying bills and estate administration expenses, filing tax returns, making distributions to beneficiaries, and providing an account of all transactions to probate court. This process often also includes obtaining a new federal tax ID number for the estate, opening an estate checking account, selling real estate and vehicles, and liquidating or transferring probate assets.

Executors act in a fiduciary capacity, and as such, a high level of accountability is required for their work. An attorney experienced in probate and tax matters can help with all aspects of the estate administration process and guide an executor to serve as a responsible fiduciary.

Do estates get “tied up in probate” for years?

An estate generally must stay open until six months from the date of death to allow creditors to make any claims they may have against the estate. Typically, if an estate stays open longer than six months, it is because more time is needed for an executor to sell the decedent’s house or file the decedent’s final income tax return. The efficiency of the probate court process is mostly dependent on how quickly assets are sold or transferred, not on the efficiency of probate court itself.

Is probate expensive?

Probate court costs are limited to relatively small filing fees, regardless of the size of the estate. In Hamilton County, Ohio, the cost is usually $260 for a full estate. However, the largest estate expenses are typically attorney fees and executor fees, which may be based, at least in part, on the amount of assets in the estate.

Attorney fees: Attorney fees are typically determined in one of three ways: a percentage of the assets involved (based on the guidelines below), an hourly rate, or a flat fee based on the time and expertise required for the estate.

Hamilton County Probate Court has guidelines for what is ordinarily considered to be a reasonable attorney fee: 5.5% for the first $50,000; 4.5% for amounts up to $100,000; 3.5% for amounts up to $400,000; and 2% for amounts over $400,000. The attorney may also charge 1% on non-probate assets owned by the decedent. Any fee above the guideline amount requires special approval of the court.

Attorney fees are payable at the end of the estate process when the final account is prepared and final distributions are being made to beneficiaries, unless otherwise approved by the court.

Executor Fees: Executors can be compensated for the responsibility taken and the time and effort they put in to complete the estate process. Executor fees in Ohio are set by statute: 4% of the first $100,000 of probate assets; 3% of the next $300,000; and 2% of the assets above $400,000. In addition, there may be a fee of 1% on non-probate assets (except assets in survivorship, for which there can be no fee). Executors can charge only 1% on the value of real estate if it is distributed to a beneficiary instead of sold. Executor fees are considered taxable income.

Some executors consider their services to be a gift to their families and choose to forego the fee. Other executors choose to take the fee because of the complexity of the estate or other factors. That decision lies entirely with the executor.

What about taxes?

Decedent’s final income tax return: Executors are responsible for filing the decedent’s final income tax return if one is necessary, as well as filing any income tax returns for the recent years that the decedent may not have filed. Any tax owed must be paid from the estate, and any tax refund will be added to the probate assets.

Estate/inheritance taxes: An “estate tax” is a tax based on the total value of assets owned by a decedent at his or her time of death. Ohio has repealed its estate tax, effective January 2013. Federally, the estate tax only applies if an individual has more than $13.99 million in assets at death (figure for 2025).

Income taxes for the estate and beneficiaries: Regardless of whether an asset is probate or non-probate, the income tax ramifications to beneficiaries depend on the type of asset being inherited.

- Some assets, such as bank accounts, non-IRA CDs, vehicles, and life insurance are not taxed as income.

- Other assets such as IRAs, 401(k)s, interest on savings bonds, and gains on annuities are taxable and must be reported on an income tax return for the estate or the beneficiary when withdrawals are made.

- Investments such as stocks, mutual funds, and real estate receive an adjustment in basis to the fair market value on the date of death (instead of the purchase price). This adjustment typically reduces capital gains or losses to a negligible amount if the asset is sold soon after death.

- Interest and dividends earned after the date of death are taxable.

Executors are responsible for filing an income tax return for the estate to report any income from probate assets. Attorney fees and executor fees are deductible on the estate income tax return. Any net income or excess deduction is distributed proportionally to the beneficiaries on a Schedule K-1 tax form.

For assets inherited directly through beneficiary designation or joint ownership, beneficiaries receive tax forms directly from the various financial institutions – not on a K-1 form issued by the estate. Note that for jointly-held investments, the adjustment in basis applies only to half of the asset’s value.

If you are handling an estate as an executor, administrator, or a surviving spouse, we would be happy to meet with you to answer questions, help explain the work that will be necessary, and provide a quote for what we would charge to assist with the estate. If you would like to schedule a meeting, please contact our office.